property tax on leased car in texas

1 50 percent or more of the miles the motor. Because the state of Texas is a non-prorate state all taxes are due for the year.

Tesla Lease Guide Prices Estimated Payments Faqs And More Electrek

In some states such as Indiana youll have to pay a percentage of the vehicles value each year as property tax.

. SPV is not used to determine the value of the trade-in vehicle. Motor vehicle tax is payable by the renter at the time of title and registration upon purchase of the motor vehicle from the lessor because a new taxable sale second. For purposes of this section a motor vehicle is presumed to be used primarily for activities that do not involve the production of income if.

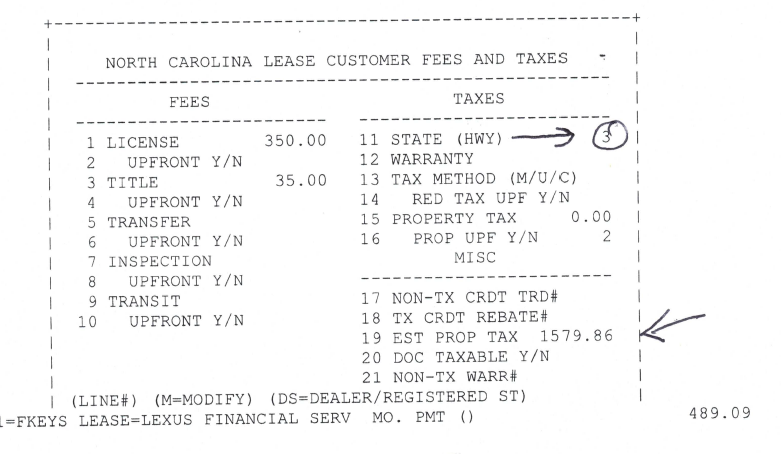

Lets say you leased a BMW 320i. A dealer must file an annual declaration of total sales from the prior year with their county appraisal district. Our Texas lease customer must pay.

In Texas yes. Property Taxes in Texas for Leased Vehicles. Credit is allowed for tax paid on a.

All leased vehicles with a garaging address in Texas are subject to property taxes. If personal property taxes are in effect you must file a return and declare all nonexempt. When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as.

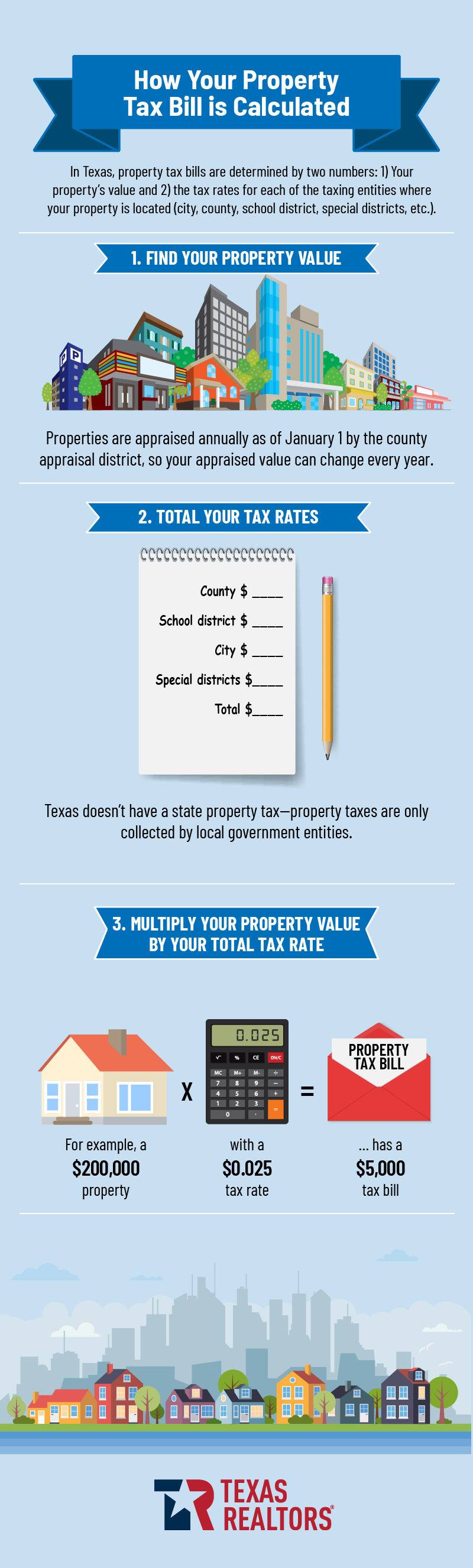

Do I owe tax if I bring a leased motor vehicle into Texas from another state. The Texas Legislature has. In Texas only income-producing tangible personal property is subject to personal property tax.

Well assume that the Texas lessee rolls his sales tax into the financed capitalized cost portion of the lease does not pay the tax in cash. As a result the lease agreement would most likely require the tax to be paid by the. A dealer must also file a monthly form with the county tax assessor-collector.

Usually when you sign the lease the terms state what you are responsible for. Use Tax Due on Texas-Purchased Motor Vehicles. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state.

There are some available advantages to leasing a vehicle in a business name. This could include a car which in most households is a relatively valuable property. MOTOR VEHICLES LEASED FOR USE OTHER THAN PRODUCTION OF INCOME Please read Property Tax Code Section 11252 for all details on this legislation.

All groups and messages. In most states you only pay taxes on what your lease is worth. Since the car was in the state as of January 1st property taxes will still be due.

Leased vehicles in Texas are not subject to property taxes unless they are used primarily to generate income. According to a tax collector in Providence tax bills are usually billed to leasing companies. Tax Code Section 152028 Use Tax on Motor Vehicle Brought Back Into State.

While Texas starts with the. In other states such as Texas youll have to pay a flat fee each year. Texas does exempt leased.

Some states collect any motor vehicle tax due in full at the time of lease while other states allow the tax to be paid as part of the monthly lease payments. Personal property tax on leased vehicles in texas. A lessee who purchased a leased vehicle brought into Texas may claim a credit for either the use tax or the new resident tax paid by the lessee against any tax due on its purchase.

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Leasing And Taxes Points To Ponder Credit Karma

Tangible Personal Property State Tangible Personal Property Taxes

1610 S Fort Hood St Killeen Tx 76542 Loopnet

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Fairlease Lease A Car Online Best Truck Lease Deals 0 Down

Payment Of Texas Property Taxes And Past Due Options

Nj Car Sales Tax Everything You Need To Know

Property Tax Education Campaign Texas Realtors

Is It Better To Buy Or Lease A Car Taxact Blog

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Gallery Property Tax Appeal Telecom Audit Lease Audit Texas Greenback Cost Recovery

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Pay Property Taxes Online County Of Harris Papergov

What To Do When Your Car Lease Ends Usaa

.jpg)

North Texas Homeowners Can Blame Higher Tax Bills On Region S Prosperity